Building Foundations for Resource Management

A new series of children's books reminded me of something I learned years ago: it's never too early to build an understanding of resource management and financial literacy.

In my work, I see clients with varying degrees of engagement in their own finances. Preparing financial reports is one thing—but ensuring the information is truly processed and connected to daily habits is another. Without that connection, clients can drift between aspirations and constraints, unable to see how everyday choices affect long-term outcomes.

Lessons from the Classroom

This gap reminded me of my time volunteering at a daycare in college. One of the ground rules was that we weren't supposed to say "no" directly to kids. Instead, we redirected their attention. For example, instead of saying "no running," the preferred phrase was "inside we walk." It taught me that framing limits as choices makes them easier to accept. The same principle applies to money: financial boundaries work best when people understand them as options, not just restrictions.

Another lesson came from the way children learned to share toys. Even personal toys brought from home had to be shared—or put away in a cubby for the day. If a child wanted to play with another's toy, they would ask for a five-minute check-in. Most of the time, kids didn't even need the full five minutes before willingly handing it over. By modeling sharing and giving structure to transitions, we reduced tantrums and made time management tangible for kids who didn't yet grasp clocks.

These early lessons in redirection, sharing, and transition are powerful examples of resource management. They highlight that time, energy, and access are not unlimited—but when structured and communicated clearly, limits feel manageable instead of overwhelming.

Why Little Economists Matter

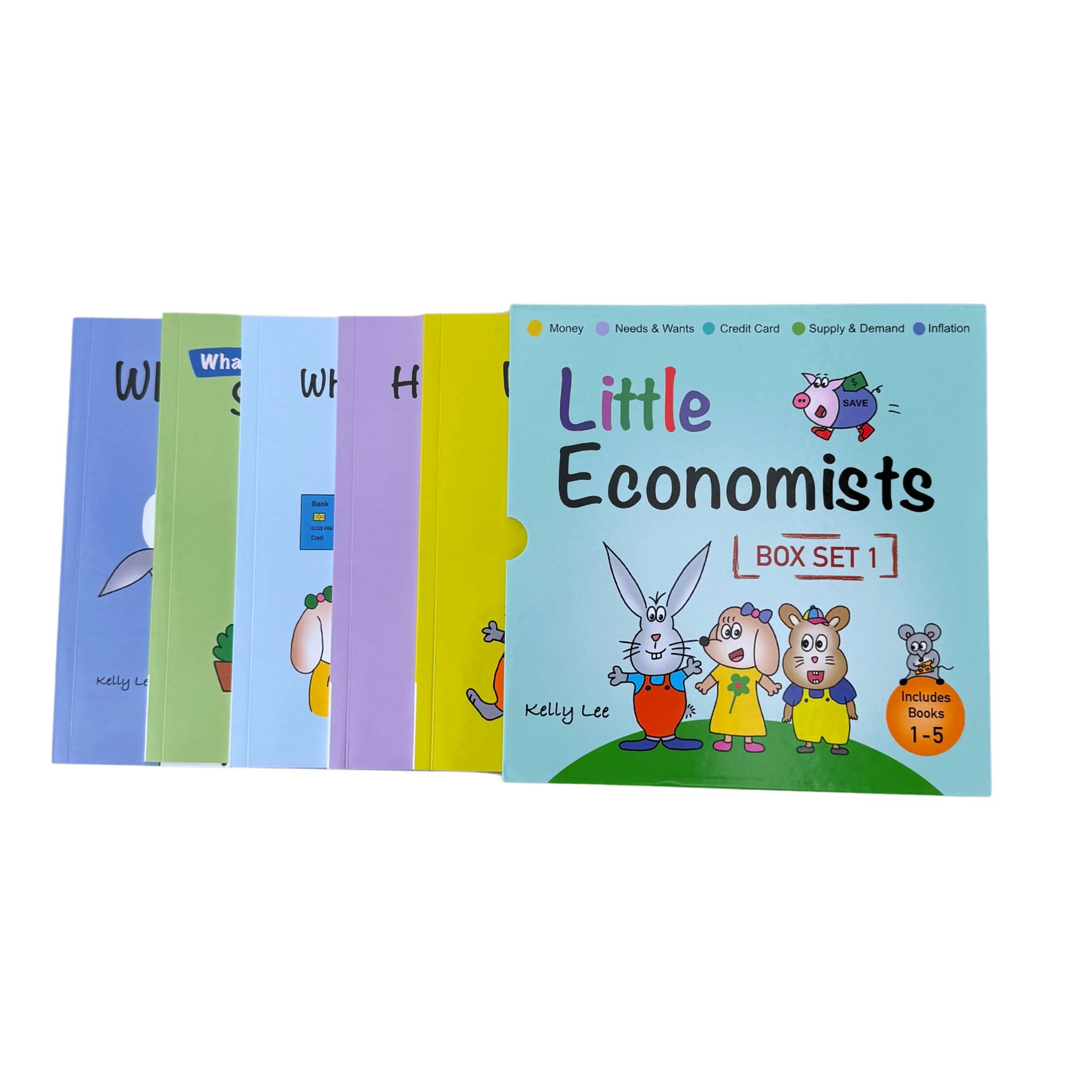

That's why I found the Little Economists Box Set 1–5 so valuable. These books aren't meant to be read once and shelved. They're building blocks that spark ongoing conversations, helping children internalize that resources—whether time, toys, or money—must be managed thoughtfully. Framing these lessons early plants the seeds for true financial literacy for children.

From Kids to Businesses: Financial Foundations

In my practice as an accountant and tax advisor, I see the difference such foundations make. Clients with early exposure to money management skills are less likely to shy away from complexity. They approach challenges with confidence, knowing how to weigh trade-offs and adjust course. For them, resource management isn't just about money—it's about using time, effort, and liquidity in ways that align with their goals.

Just as children benefit from early lessons in financial literacy, businesses thrive when their financial foundations are clear.

If you'd like support translating financial reports into real decisions, or managing liquidity with greater clarity, I'd be glad to connect. Contact me here to initiate the conversation.

As a special collaboration, you can access the books with an exclusive promo code: GELWARG15 at econforkids.com.